Using QuickBooks Mobile, you’ll improve business relations, put out fires before they start and unchain yourself from your office computer.

There are only a few reasons why you wouldn’t be using QuickBooks Mobile on your smartphone. Maybe you don’t have a smartphone. Or when you’re out of the office, you don’t want to be available for accounting work. Or you might not think that it has enough features to make it worth using.

While the first two reasons are matters of personal preference, the third just isn’t true. QuickBooks Mobile automatically – and almost instantly – synchronizes the data from your desktop or laptop computer copy of QuickBooks. While it’s only focused on sales, not payables or payroll, you can manage receivables quite nicely whether you’re in a customer’s office or at a trade show or community event – or sitting on the couch at home.

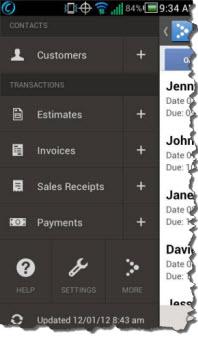

Figure 1: You can see this screen no matter where you and your smartphone are (the recently-upgraded Android version is pictured here).

Countless Scenarios

There are numerous situations where you might want to access, add or edit customers, estimates, invoices, sales receipts or payments when you’re not near the PC where QuickBooks is installed, like these:

- You do a half day of onsite training and your client wants to pay you cash right then to qualify for a discount. You can record the payment and email a sales receipt.

- You’re on the road and you want to see how well your bookkeeper is managing receivables. QuickBooks Mobile displays three views: recent activity, today and upcoming.

- You’re with a client who would like to give you a check to get current, but he or she can’t find the invoice. Rather than calling your office and sitting on hold until someone has time to look, you can pull up the form on your smartphone to discuss it.

Figure 2: You can record sales receipts and payments on your smartphone – even schedule appointments that move to your Google calendar.

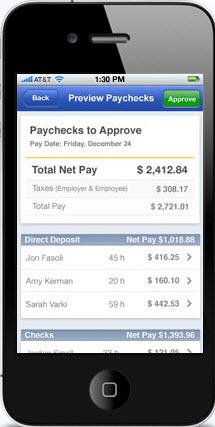

The Perils of Payroll

QuickBooks Mobile doesn’t support payroll, but Intuit Online Payroll does. Like QuickBooks Mobile, the app itself is free (of course, you have to pay for the service itself). You can view the most recent payroll run and employee information, as well as preparing, previewing and approving the current payroll.

Neither app is available yet for the iPad, though QuickBooks Online is.

Neither app is available yet for the iPad, though QuickBooks Online is.

Paper or Plastic?

If you’ve been in business for very long and still don’t accept credit cards, you have an idea of how many sales you’ve lost. And QuickBooks Mobile won’t let you do so, anyway. You’ll need to get a merchant account from Intuit Merchant Service for QuickBooks (fees apply). A merchant account allows you to accept plastic through QuickBooks itself, your web browser, your web storefront – and on your smartphone or iPad.

Figure 3: Missed your flight and afraid you’ll miss the current payroll run, too? Intuit Online Payroll gives you access from your Android or iPhone.

To do so, you’ll need to apply for a merchant account and download Intuit’s free GoPayment app. You can either swipe cards on the free mobile reader or type numbers in. Your customers sign their names on the surface of your mobile device, and you can print or email a receipt.

Figure 4: You’ll need to get acquainted with the Intuit Merchant Service Center to work with credit card payments.

It would be nice if those credit card payments were just instantly zapped into the right places in QuickBooks, but alas, it isn’t so. You’ll need to do some setup and processing both within QuickBooks and in the online Intuit Merchant Service Center. We can help you with setup and your initial transactions to make sure all of your payments get through and are deposited and/or credited correctly.

We think you’ll find that once you start using all of the mobile payment services that Intuit offers, you’ll wonder what took you so long.